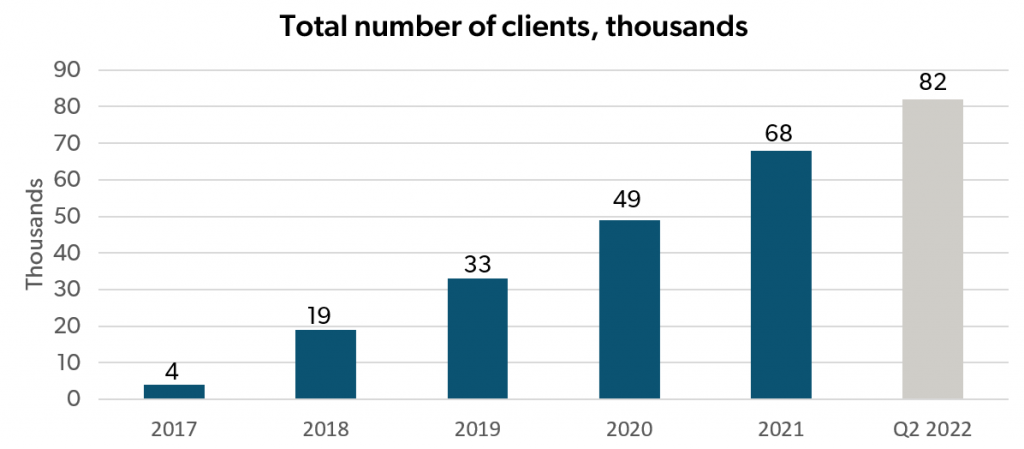

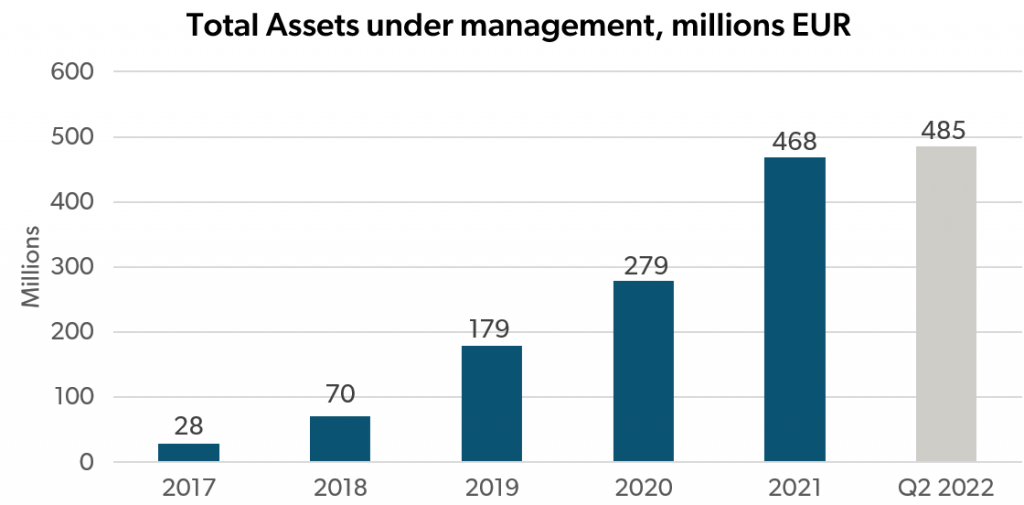

Pension manager IPAS Indexo (hereinafter – INDEXO) in the first six months of this year has achieved the fastest rise in the number of new customers, attracting 14,359 new clients to the 2nd and 3rd pillar pension plans, which is by 21.3 percent more than at the beginning of this year. The total number of INDEXO customers on June 30 was 81,883 compared to 67,524 customers in the beginning of the year. The assets managed by INDEXO at the end of the first six months of this year accounted for EUR 484.5 million in contrast to EUR 468.54 million at the start of this year.

Since June 30, 2021 the number of INDEXO customers increased by 45 percent or 25,488, while the volume of the managed assets rose by 32 percent or EUR 118.4 million.

“The results of the first six months of this year show that our growth is accelerating – in the first six months of this year we have attracted almost as many new customers as in full 2021, when the number of new customers reached 16,468. The achievement of our pension management operations solidifies the confidence about INDEXO value for the current company shareholders and those who will join the group of shareholders during the current IPO,” said Valdis Siksnis, one of the founders of INDEXO and chairman of the company’s board.

As reported, INDEXO IPO process offers shares in the pension management company and in the future it is planned that the new INDEXO bank will be a subsidiary of the pension management company. During this year, INDEXO plans to submit an application for a bank license in line with the regulations and will gradually introduce banking services – starting from service of individuals, followed by corporate banking.

According to INDEXO IPO prospectus, the IPO will officially close at 15:30 on 11 July. Given that the time of accepting subscription applications may vary depending on the investor’s bank, INDEXO advises investors to submit their subscription applications by 12:00 on 11 July.

INDEXO IPO retail offering will take place in Latvia and Estonia, giving the opportunity to subscribe for INDEXO shares to any interested party that has a securities account with a financial institution that is a member of the Nasdaq Riga stock exchange, as provided in the IPO Prospectus. To subscribe for the shares, an investor must read the IPO prospectus and issue a subscription instruction to the bank with which he or she has a securities account.

In case of oversubscription, the shares will be allocated in accordance with the allocation principles described in the prospectus, giving preference to INDEXO 3rd pension pillar customers (within retail offering) and the existing shareholders (within shareholder offering).

Following the IPO, INDEXO shares will be listed on the official Baltic List of the Nasdaq Riga stock exchange. The organizer of the Nasdaq auction is Signet bank, and INDEXO IPO legal consultant is law firm Eversheds Sutherland Bitans.

INDEXO is the fastest growing pension management company in Latvia by the number of customers as more than 80,000 customers have entrusted their pension management to INDEXO for a total sum of almost EUR 500 million. INDEXO was established in 2017 by a group of 30 experienced business people with an aim to bring the latest approaches in asset management to the Latvian pension market. INDEXO is built on the values of innovation, transparency, integrity, and strong business fundamentals, forming foundation for future growth.

More information is available here: www.indexo.lv.

Bank (credit institution) licence is subject to authorization granted by European Central Bank based on Financial and Capital Market Commission’s (FCMC) proposal.

Disclaimer: This announcement is an unpaid marketing communication in accordance with the Prospectus Regulation and does not constitute investment advice or an offer. The information provided herein contains general forward-looking statements on the intended IPO of INDEXO.

Every investment decision must be based on a prospectus approved by the Latvian Financial and Capital Market Commission. An approved prospectus is published on INDEXO website (www.indexo.lv). Approval of the prospectus should not be considered an invitation for purchase of shares. Before investing in the shares, please read the prospectus carefully to learn about possible risks and gains.