3rd pension pillar

INDEXO 3rd pension pillar is a simple and effective way to increase your pension savings without unnecessary worries and mandatory obligations. In addition, the state pays you extra for saving.

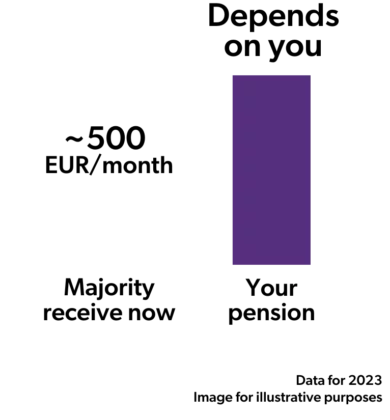

The government pension will provide up to 50% of your last salary before retirement. Will that be enough for you?

How does INDEXO 3rd pension pillar work?

We offer and our customers appreciate

the globally recognized index approach for 50 years

automated plan for customer needs

transparency in costs and performance of plans

a user friendly portal to follow what is happening with your retirement savings

Automated

and robotic investing

Automatic portfolio allocation

Manual portfolio allocation

Get a tax refund on contributions to 3rd pension pillar

For a part that does not exceed 10% of the salary or no more than 4,000 EUR per year, submit an annual income declaration and recover up to 20% of the deposited amount. You will receive a tax refund if you are a VAT (individual income tax) payer.

Find out more

3rd pension pillar benefits

Voluntary contributions

Tax refund

You can spend from the age of 55