Loan up to €20,000

We will prepare an individual offer for

a loan from €500 to €20,000

a loan from €500 to €20,000

Beneficial conditions

From 9 % per year

Free issuance

Free issuance

Fast

payout

payout

We examine and

issue in 5 minutes

issue in 5 minutes

Easy

repayment

repayment

Repayment period

from 6 to 60 months

from 6 to 60 months

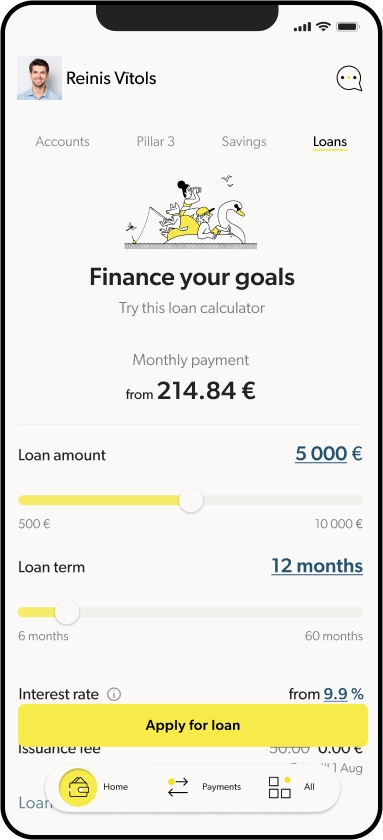

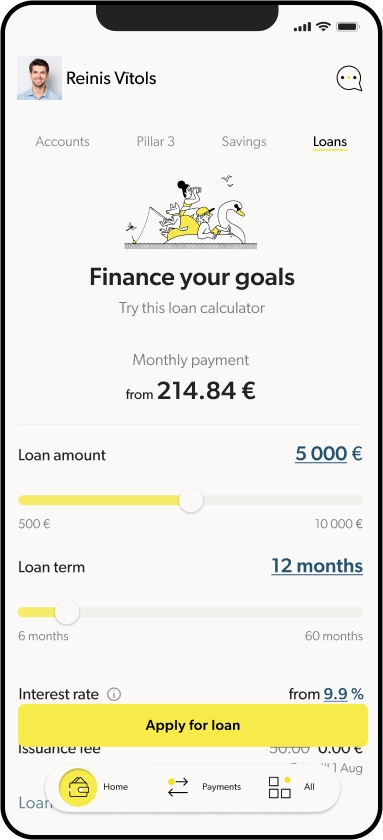

Consumer credit calculator

Find out your available reserves and get a loan in a few minutes

500

20000

EUR

Min loan amount is €500.

Max loan amount is €20,000.

6

60

months

Min loan term is 6 months.

Max loan term is 60 months.

Monthly payment 181,84 €

Interest rate From 9 % a year

Issuance commission

50€

0 €

Free until November 28

The calculation of the calculator is for informational purposes only. Each client’s situation is evaluated individually.

Calculation assumption

Get a quick and reasonable loan

in just 5 minutes*

Fill out the application

Receive an answer

Sign the contract electronically

Receive money in the bank account

*Average time for a customer registered in INDEXO Bank's mobile app from the loan application to the withdrawal of money into the account

Support for your goals

For home repair or improvement

For education

For other purposes

Car purchase or repair

For health

For consumption purposes

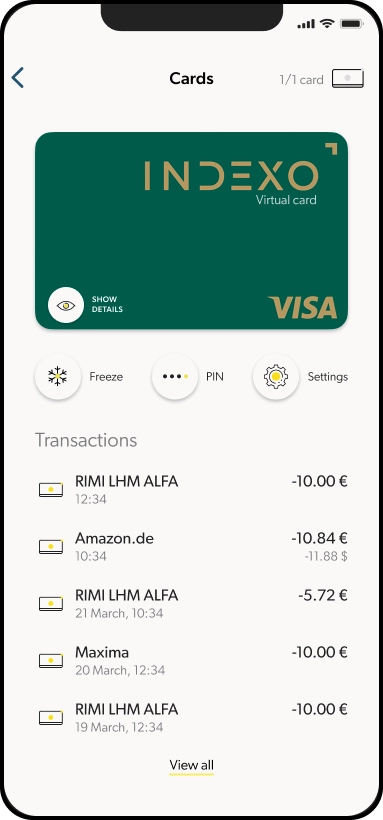

Shop with peace of mind!

Purchases made with the INDEXO card are insured worldwide for 180 days from the moment of payment.

Questions and answers

What is the purpose of a consumer loan?

The INDEXO consumer loan can be used for a wide variety of purposes, for example, but not limited to, travel, education, medical services, a larger purchase or daily consumption needs. Spend as you wish.

What is the maximum amount of consumer credit that can be applied for?

The maximum consumer credit loan amount is €20,000.

How can I apply for a consumer credit?

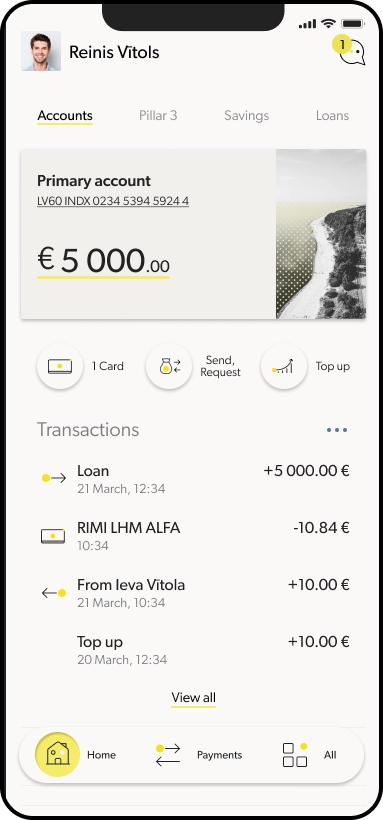

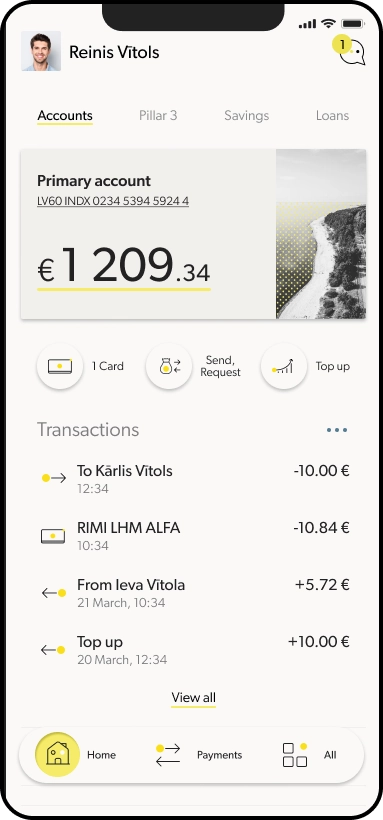

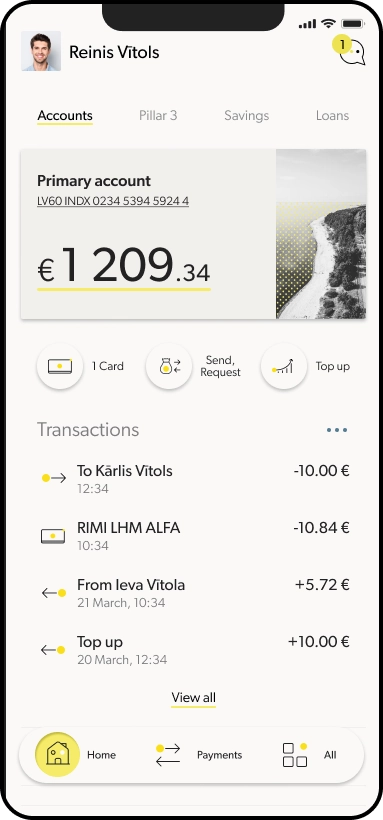

To apply for a consumer credit, go to the “Credit” section of your INDEXO Bank app and press “View your available offer”.

What information must be provided to receive a consumer loan?

The following information must be provided in the application form:

- current location;

- the reason for taking the loan;

- information on existing loans;

- residential address (if not determined automatically).

Where can I view my credit information?

You can view information about your loan in the INDEXO Bank app – go to the “Loans” section and press “Detailed information”.