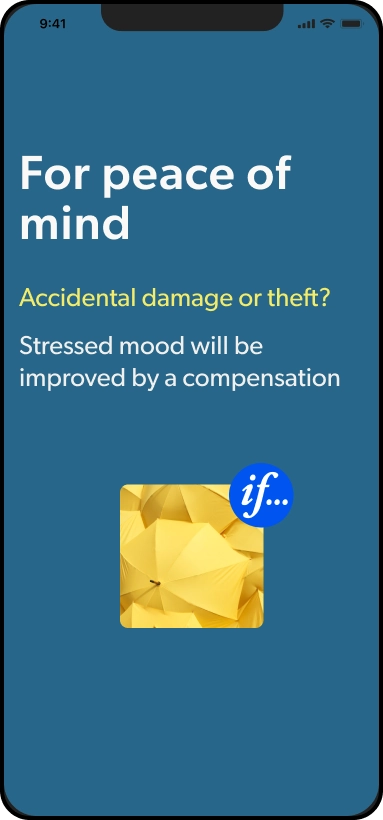

Shop with peace of mind

up to 7 500 €

worldwide*

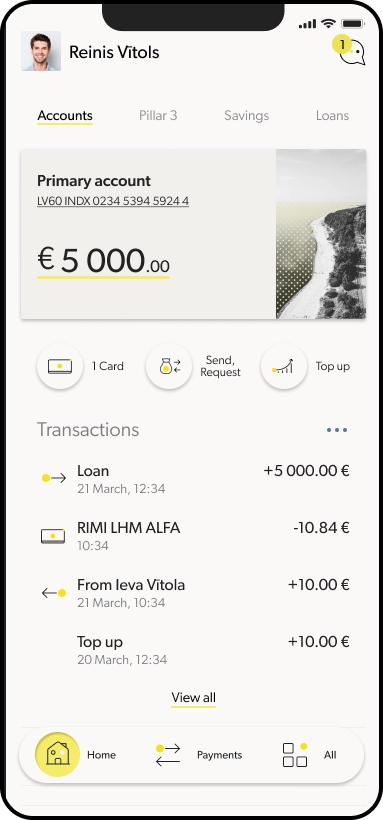

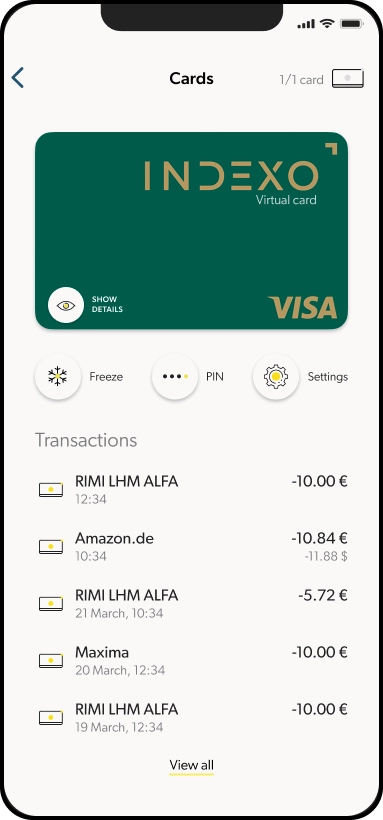

INDEXO insurance coverage

using an INDEXO account or card.

Questions and answers

What purchases are insured?

Insured are all purchases that:

- are paid with a valid INDEXO card – including those purchased on the Internet or with the help of other distance means;

- are new (unused) movable property;

- does not exceed the amount of 7 500 €*.

For example: computer, household appliances, toys, musical instruments, sports and active leisure items, shoes, clothing, furniture, other durable goods.

*Except for purchases listed in the Purchase Insurance Terms.

What risks are insured?

Damage incurred in the following cases shall be compensated:

-

sudden and unexpected damage;

- destruction of the object;

- theft (if committed by breaking and entering) or robbery.

How much compensation will I receive?

These are the maximum amounts that If Insurance will compensate after an accident. If the actual losses are lower, the compensation will be paid in the amount of the actual losses:

- compensation limit for one purchase – 7 500 €;

- compensation limit for one accident – 7 500 €;

- compensation limit for certain purchases per accident* – 1 000 €;

- the total annual insurance amount for one card holder is – 15 000 €.

*Purchases listed in the Purchase Insurance Terms.

How to apply for compensation and what kind of documentation is required?

As soon as possible, but no later than within five working days from the moment it became possible, apply for compensation on the Internet: (links).

If you have any questions, contact If Insurance: +371 67338333.

Copies of documents related to the accident should be attached to the compensation application:

- an invoice or receipt confirming the purchase;

- an internet bank statement confirming that the purchase was paid with an INDEXO card;

- depending on the occurrence of the specific risk, also the following documents:

- in the event of damage or death – an estimate issued by an authorized repair company on the costs of the planned repair, including transport costs if transport is necessary.

- in case of theft or robbery – a police report.

Is the insurance valid if the card is lost or stolen?

Yes, the insurance is valid if you renew the card or replace it consecutively with a new one after the expiration of the previous card.