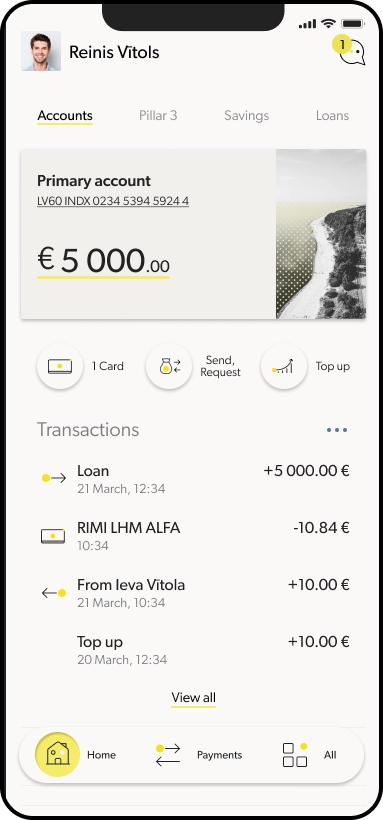

You drop, we top

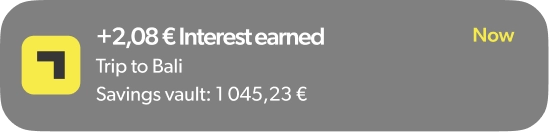

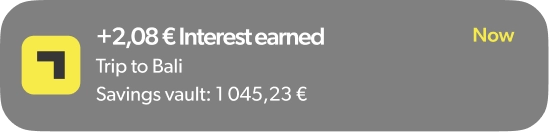

reinvested for you at the beginning of the next month

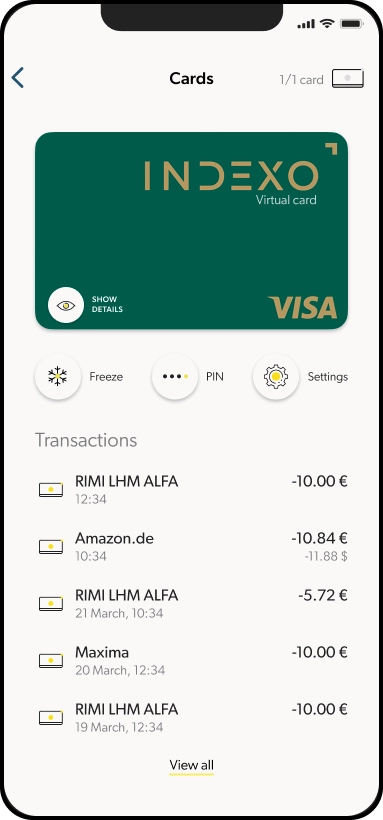

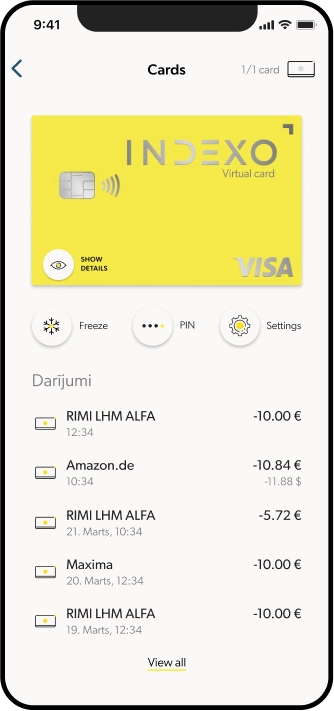

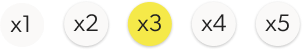

With round up , you save

whenever you pay by card

savings

fifth speed for rounding up purchases!

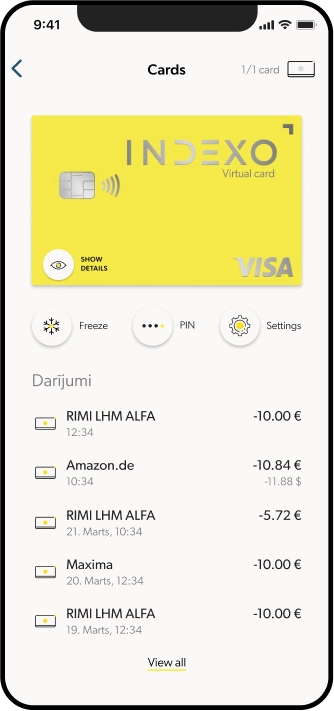

INDEXO Bank plans

Sudrabs

Zelts

Zelts 3 months for free!

Platīns

Want to earn more?

INDEXO pays you up to 4% per year

balance, for savings and term deposits.

Questions and answers

What are the differences between a savings vault and a term deposit?

Both types of savings are suitable for fulfilling big and small dreams. However, there are several differences between them.

|

Function |

Savings vault |

Term deposit |

|

Deposits and payouts |

Possible at any time without restrictions |

Deposit only at the beginning, it is not possible to top up |

|

Interest rate |

Variable, depends on the bank’s rules |

Fixed, higher than in a savings vault |

|

Availability |

Money is available anytime |

Money is only available at the end of the term |

|

Compound interest |

No |

Yes, interest is reinvested |

|

Early withdrawal |

Yes, without penalty |

Yes, but with penalty and without accrued interest |

|

Rounding options |

Yes, it is possible to use the rounding too |

No |

How is interest calculated for saving in savings vault?

Interest is calculated on the savings vault balance at the end of each day and is credited to the savings vault once a month. When calculating interest, we apply an annual interest rate and assume that there are 360 days in a year.

Remember that personal income tax will be automatically deducted from the interest paid in the amount specified in the legislation.

Can I freely deposit and withdraw money into the savings vault?

Yes, that’s the appeal of a savings vault – add and withdraw money without limits whenever you want.

How does purchase rounding works?

Another convenient way to add to your savings vault is the payment rounding tool. This feature allows you to automatically round each purchase to the nearest round number and transfer the difference to your savings vault.

For example, if you make a purchase for 1.30 euros, 70 cents will be transferred to your savings account. You can set second, third or even fifth speed for rounding purchases. This will determine how many times this amount will be multiplied – for example, x2 means that the amount will be doubled and 1.40 euros will be transferred. It will help you save money easily and seamlessly every time you make any purchase.