ABOUT YOU

CONTRIBUTIONS

Pension projection scenario

Favorable

Pessimistic

Optimistic

Accumulation

0 EUR

Amount of pension per month

0 EUR

Recovered PIT

0 EUR

INDEXO 3rd pension pillar is a simple and effective way to increase your pension savings without unnecessary worries and mandatory obligations. In addition, the state pays you extra for saving.

The government pension will provide up to 50% of your last salary before retirement. Will that be enough for you?

Different income percentages

5%

good start

10%

Good pension, good use of tax benefits

20%

Western standard

You can receive a 20% personal income tax refund (IIN) for part of the contributions, which do not exceed 10% of the annual gross salary or no more than EUR 4,000 per year, by submitting an annual income declaration. You will receive a tax refund if you are a VAT payer.

The total savings at the indicated planned retirement age, based on the entered information and calculation assumptions.

ABOUT YOU

CONTRIBUTIONS

Favorable

Pessimistic

Optimistic

Accumulation

0 EUR

Amount of pension per month

0 EUR

Recovered PIT

0 EUR

the index approach recognized worldwide for 50 years

an automated plan tailored to client needs

cost transparency and plan performance results

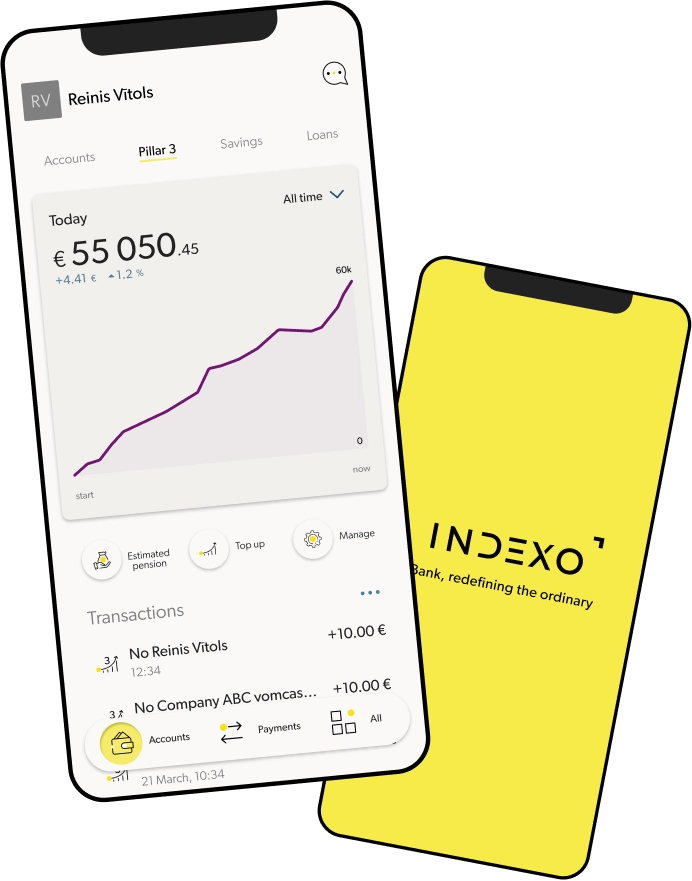

easy savings management in the INDEXO Bank mobile app