How does the pension

system work in Latvia?

To maintain your comfort level and enjoy a prosperous retirement,

it's essential to understand and take care of your pension savings early on.

Using knowledge to debunk pension myths

On average, we will spend 15.5 years in retirement

It is harsh, but it is widespread among the residents of Latvia to believe that they will not reach retirement age or will only spend a few years in retirement. However, data shows the opposite. Upon reaching the age of 64, on average, we will spend 15.5 years in retirement (18 years for women and 13 years for men).

You will have a pension if you take care of it

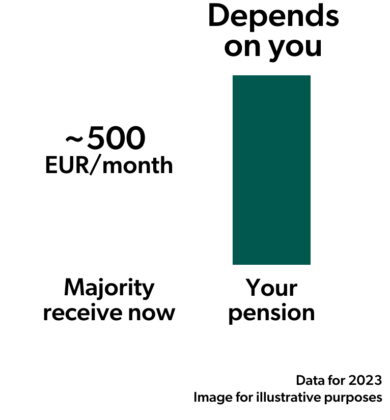

Nowhere can you rely solely on the state pension for a good life. The same applies to Latvia.

If you want a comfortable retirement, you need to take care of yourself and start saving somehow. The third pension pillar is a great first step because when you save for yourself, the state even adds a contribution. Each year, you can receive a 20% tax refund on your contributions (up to 10% of your gross salary or €4,000).

The earlier you start building your savings, the smaller your monthly contributions must be to reach the desired amount for a comfortable life.

You should start thinking about your pension from your first salary

Yes, you need to make some (preferably smart) choices early on that can significantly impact your pension savings. From your first salary, 20 % of your social contributions go towards your future pension: 14% to the first pillar and 6% to the second.

The first pillar operates on the principle of solidarity – the current workforce funds the pensions of current retirees. However, the second pillar is much more interesting because it is a real savings account for you, and you can influence what happens.

To achieve the best results, you need to choose a pension plan that matches your age. If you don’t, you will be randomly assigned to one of the available pension plans in the Active 100 % category.

Your second and third pillar pension capital is inheritable

The accumulated capital can be inherited by the designated heirs or according to civil law provisions.

We are proud that we, together with like-minded individuals, achieved the inheritability of the second pillar pension. It seems self-evident, but until 2020, all accumulated capital was added to the state’s special pension budget and could not be inherited.

Learn more about pension inheritance at indexo.lv/manto.

Time and regular contributions are your allies

The first and second pillar pensions can provide up to 50 % of your pre-retirement income. To maintain your quality of life, you need to create additional savings.

Using the third pillar pension is practical because you can receive a tax refund on your contributions.

A good starting point for contributions is 5-10 % of your monthly income. Studies show that regular contributions improve the chances of accumulating more in the long term by reducing market fluctuation risks and maintaining healthy discipline.

How is your pension formed?

Pension system in action

How to save a million for retirement with a monthly salary of 1,300 EUR?

and what you need to do to ensure a prosperous retirement,

and possibly even become a millionaire.